ICICI Prudential Innovation Fund : An interesting take on innovating companies By N Vijayakumar, Managing Director, Click4MF Private Limited, Chennai In a fast changing world, businesses may not thrive sustainably without innovating themselves. Innovation, here means to r…

Salaried investors: inform your employer about the Which Tax regime

Kind Attn Salaried investors 1) Please inform your employer about the *old regime & maximum by the end of this month, before your employer deducts TDS on the first salary slip of the new financial year. In the absence of a *specific choice* ( old or new), the default is …

Understanding mutual fund NAVs .by Dwaipayan Bose

Understanding mutual fund NAVs .by Dwaipayan Bose Net Asset Value or NAV is a very important term in the lexicon of mutual funds. NAV is the market value or price of one unit of a mutual fund scheme. It is the per unit price you pay or get when you are buying or selling (red…

How to Create an Ideal Investment Portfolio? by Ms. Usha Nair

How to Create an Ideal Investment Portfolio? A Personal Finance Webinar on "Investment Opportunities Beyond Equities and Asset Allocation". Guest Speaker: Ms. Usha Nair Date: 06.06.2023, Saturday Time: 10:30 AM to 12:00 PM (IST) Medium: Zoom BOOK YO…

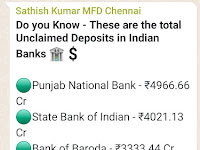

Indian banks have ₹31078 cr. unclaimed deposits of customers Reasons ?

Do you Know - These are the total Unclaimed Deposits in Indian Banks 🟢Punjab National Bank - ₹4966.66 Cr 🟢State Bank of Indian - ₹4021.13 Cr 🟢Bank of Baroda - ₹3333.44 Cr 🟢Canara Bank - ₹3192.01 Cr 🟢Union Bank of India - ₹2809.74 Cr Indian banks have more than ₹31077.88 cr.…

The status quo in the Repo rate by RBI will give further momentum to growth: Dr A Sakthivel, President, FIEO

The status quo in the Repo rate by RBI will give further momentum to growth: Dr A Sakthivel, President, FIEO Commenting on RBI maintaining the repo rate at 6.5%, when US Fed has raised the rate by 25 basis points last fortnight and most people were expecting RBI to fol…

The RBI's choice to keep policy rates unchanged will offer relief to borrowers.

The RBI's choice to keep policy rates unchanged will offer relief to borrowers. Vimal Nadar, Head of Research at Colliers India The RBI, has decided to keep its repo rate unchanged at 6.5%, with its stance at "withdraw of accommodation" and is an encouragin…

Pause in repo rate hike: Big cheer for the real estate industry!

RBI MPC Announcement by Mr. Shishir Baijal, Chairman & Managing Director, Knight Frank India for your perusal. Pause in repo rate hike: Big cheer for the real estate industry! "Today's pause in the rate hike cycle is a very positive and welcoming move by the …

he consumer sentiment within the residential real estate segment will witness a further uptick.

Ram Raheja, Managing Director at S Raheja Realty on the " RBI MPC Announcement " " RBI's prudent choice to hold off on raising rates is a welcome move after consistent raise in repo rate in the last few cycles. The realty sector was hoping for a pause a…