Mr. K. Kirubakaran, AMFI Registered MFD SBI MF launches SBI NIFTY50 Equal Weight Index Fund The NFO opens on 2024 January 16 and closes on January 29. SBI Mutual Fund has launched SBI NIFTY50 Equal Weight Index Fund, an open-ended scheme replicating / tracking NIFTY50 Equal…

Minimum Investment Rs. 100 : Sundaram Multi Asset Allocation Fund

Mr. K. Kirubakaran MFD Minimum Investment Rs. 100 : Sundaram Multi Asset Allocation Fund Sundaram Mutual Fund announced the launch of the Sundaram Multi Asset Allocation Fund, an open-ended scheme investing in equity, debt and money market instruments, and Gold ETFs. The sche…

Check out Ways to be millionaire Overcoming

Sunday Financial Literacy Check out Ways to be millionaire Overcoming Financial Obstecals. • Educate Ownself Financially • Develop Strong Work Ethic • Create Multipule Income Streme • Live below your Means • Invest Wisely • Set Clear Goals and Plans • Establish Netwo…

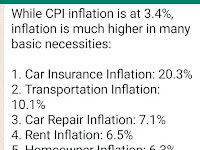

CPI inflation is at 3.4% But agar inflations are..

While CPI inflation is at 3.4%, inflation is much higher in many basic necessities: 1. Car Insurance Inflation: 20.3% 2. Transportation Inflation: 10.1% 3. Car Repair Inflation: 7.1% 4. Rent Inflation: 6.5% 5. Homeowner Inflation: 6.3% 6. Hospital Services Inflation: 5.5% 7. Food …

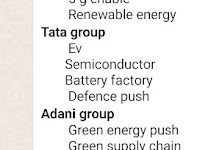

Share investment Next 5 years focus

*Next 5 years focus* *Reliance group* 5 g enable Renewable energy *Tata group* Ev Semiconductor Battery factory Defence push *Adani group* Green energy push Green supply chain *Suzuki* Ev *Arcelormittal group* …

CasagrandContracts and Our SHINE GOGLOBAL Ltd Announces Ambitious Partnership toTransform Kanniyakumari into the Cape Town of India

Casagrand Contracts and Our SHINE GOGLOBAL Ltd Announces Ambitious Partnership to Transform Kanniyakumari into the Cape Town of India ~Estimated USD 300 Million Investment to Cultivate a Conscious Tourism Community ~ Chennai, 11 th January, 2024: With a vision to transcend …

Investments; How We Grew Up :_

*_How We Grew Up :_ From ex-Girlfriend to ex-Dividend From Red Bull to Bear Bull From Munna-Circuit to Upper-Lower circuit From Future tense to Futures & Options From Black & White to Red & Green From B.Sc, M.Sc to BSE, NSE From Mutual Fun to Mutual Fund From India-TV t…

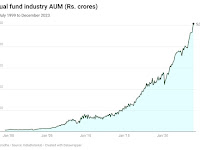

Mutual Fund Industry’s Net AUM Rs. 50,77,900 for December 2023

Mutual Fund Industry's Net AUM Rs. 50,77,900 for December 2023 Highlights AMFI Mutual Fund Industry Monthly Data for December2023: Ø Mutual Fund Industry's Net AUM has reached a momentous milestone of Rs. 50,77,900.36 for the month of December 2023 while for the mo…

Minimum Investment Rs. 500 Zerodha Fund House launches India’s first Growth Liquid ETF

Zerodha Fund House launches India's first Growth Liquid ETF Bengaluru, 9 th January, 2024: Zerodha Fund House today announced the launch of its new scheme and India's first Growth Liquid ETF - Zerodha Nifty 1D Rate Liquid ETF . The fund is expected to be listed on NSE …

The Indian mutual fund industry assets under management AUM crossed Rs. 50 lakh crores

The Indian mutual fund industry hit a landmark milestone as the assets under management (AUM) of the industry crossed Rs. 50 lakh crores in December 2023.