Choose the best pathway for your investing journey! Aditya Birla Sun Life Transportation & Logistics Fund • A theme that is growing fast with a fast-growing Indian economy India has consistently achieved pole position for its economic growth rates - its forecast cont…

Minimum SIP Investment Rs.1,000: Quant Momentum Fund..!

Minimum SIP Investment Rs.1,000: Quant Momentum Fund..! Quant Mutual Fund announced the launch of the Quant Momentum Fund . The scheme opened for public subscription will close on November 13, 2023. The scheme re-opens for continuous sale and repurchase within 5 business …

Program on NEW INCOME TAX REGIME VS OLD INCOME TAX REGIME 2023 Friday , 10th November Chennai Entry free

Program on NEW INCOME TAX REGIME VS OLD INCOME TAX REGIME How to choose the Right Regime, Tax Planning Strategies & practical tips to save your income tax on Friday , 10th November at 4-30 pm. Chennai Excellent background materials. Entry Free

Minimum investment Rs 1000 : Bajaj Finserv Banking & PSU Fund

Minimum investment Rs 1000 : Bajaj Finserv Banking & PSU Fund...! DEBT BANKING AND PSU Bajaj Finserv Mutual Fund has announced the launch of Bajaj Finserv Banking and PSU Fund , an open-ended debt scheme investing in debt instruments of banks, public sector undertaking…

Minimum Investment Rs 100- DSP Gold ETF Fund of Fund

Minimum Investment Rs 100- DSP Gold ETF Fund of Fund · Open Date 03-Nov-2023 · Close Date 10-Nov-2023 · Allotment Date 10-Nov-2023 · Investment Objective: The investment objective of the scheme is to seek to generate returns by investing in units of DSP Gold ETF. · Fund ManagerMr. …

Mahindra Finance enters into a co-lending partnership with State Bank of India

Mahindra Finance enters into a co-lending partnership with State Bank of India · Marks Mahindra Finance's foray into the Co-lending space · Partnership to unlock the potential of Priority Sector Lending (PSL) Chennai November 01, 2023 : Mahindra Finance, part of the Mah…

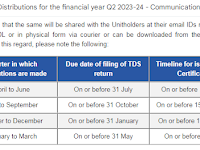

PGInvIT - Distributions for the financial year Q2 2023-24 - Communication on Tax deduction at source (TDS)

PGInvIT - Distributions for the financial year Q2 2023-24 - Communication on Tax deduction at source (TDS) Deduction of tax at source on distributions under relevant sections of the Income-tax Act, 1961(as amended by the Finance Act, 2023) This is to notify the Unitholders r…