Mutual funds have emerged as the #1 Financial investment instrument in the country, says the survey from Scripbox Tomorrow is too late Yesterday is over Now is the right moment START investing in Mutual Funds

A Personal Finance Webinar on “Myths about Wealth Creation”

A Personal Finance Webinar on "Myths about Wealth Creation" Holistic Investment Planners invite you for a Personal Finance Webinar on "Myths about Wealth Creation" Guest Speaker: Mr. Deepak Mehta - Head of Sales Management - UTI AMC Ltd. Date: 19.11.2022, S…

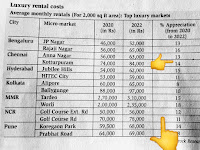

Despite Appreciation in Rental Yields in 2years, STILL Renting is so, so cheaper than owning

Despite Appreciation in Rental Yields in 2years, STILL *Renting is so, so cheaper than owning*. For Rs. 3 crores property, Just pay 60,000 RENT, which is just 2.4% per annum. Buying with EMIs & Loan, Luxury apartments doesn't make any sense for investment. N Vijay k…

Investors considering to purchase gold for investment purpose this Diwali can consider Gold ETFs

Mr Chintan Haria, ICICI Prudential AMC, on *Investors considering to purchase gold for investment purpose this Diwali can consider Gold ETFs* Buying gold on auspicious occasions is a part of the Indian tradition. Apart from cultural and traditional reasons, gold also has a…

Muhurat Trading -Outlook by JM Financial Services

Muhurat Trading -Outlook by JM Financial Services On the occasion of Muhurat Trading, we wish to share the below outlook on behalf of JM Financial Services: _Nifty is at a crucial inflexion point of 17,600 above which we can expect an aggressive price action with targets of 1…

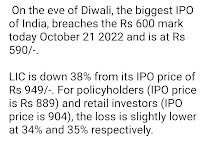

One should be very careful with IPO, especially those aggressively marketed at high price.

On the eve of Diwali, the biggest IPO of India, breaches the Rs 600 mark today October 21 2022 and is at Rs 590/-. LIC is down 38% from its IPO price of Rs 949/-. For policyholders (IPO price is Rs 889) and retail investors (IPO price is 904), the loss is slightly lower at…

Debt MFs will outperform Fixed Deposits & Ideal time to enter*

*HDFC raised 1 year CP at 7.75%* from market. Most bank 1 year CDs are at 7.50%! *All these get captured in Debt MFs like Ultra/ Money Market Funds etc* Now and next few months will provide excellent opportunities for Indian investors to invest in liquid/ultra/ money markets/…

How to contact zerodha support team

How to contact zerodha support team? For trading related queries you can raise a ticket in below link, https://support.zerodha.com/ Or You can call our support team. 08047181999 08047181888 *How to get Support code* Visit https://console.zerodha.com/profile

Big Lessons of Investment from War By - Dr. Shrikant Bawsay

Big Lessons of Investment from War By - Dr. Shrikant Bawsay 1. If you think your money is safe in Banks. You are wrong. All banks of Ukraine are closed. People are standing in long ques in front of ATMs and bank branches to withdraw their own saved money but nothing is worki…

Dollar flying or Rupee falling - Explained

Dollar flying or Rupee falling (Explained) If someone has basic knowledge of economics, will know answer of this question but in India, standard of journalist n leaders is so low that they even don't know such basics This thread will answer - dollar flying or rupee fallin…