Mutual Fund SIPs accounts stood at 2.98 CRORE! The total amount collected through SIP during December 2019

was Rs. 8,518 crore Indian Mutual Funds have currently about 2.98 crore (29.8

million) SIP accounts through which investors regularly invest in

Indian Mutual Fund sche…

AMFI Report : 2.03 crore investors have invested in Mutual funds

AMFI Report : 2.03 crore

investors have invested in Mutual funds The

latest (December, 2019) AMFI data shows that the mutual fund (MF) industry has 2.03

crore unique investors as on December 2019. 2019 ended on a positive note for the Rs.27 lakh crore Indian mutual fund indus…

Equity Mutual Fund Assets: In 6 years Rs. 2 lakh cr to Rs. 11 lakh cr

Equity

Mutual Fund Assets: In 6 years Rs. 2 lakh cr to Rs. 11 lakh cr Between

2013 and 2020, Mutual Funds have seen their equity assets zoom from Rs. 2

lakh cr to Rs. 11 lakh cr Today

(December, 2019), Rs. 8.5 lakh cr of that is invested in the top 100 stocks,

and Rs. 1.9 la…

Bajaj Finance : Systematic Deposit Plan

Bajaj Finance : Systematic Deposit Plan Bajaj Finance has launched a monthly savings plan. Investors in the Systematic Deposit Plan can choose a tenure ranging from

one to five years. However, unlike bank recurring deposits where the rate is fixed, here the

interest rate is…

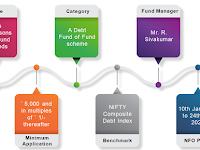

Axis All Seasons Debt Fund of Funds

Axis All Seasons Debt Fund of Funds Axis Mutual Fund has launched the Axis All Seasons Debt Fund of Funds. The Fund of Funds will invest in schemes from across fund houses and debt

fund categories. The minimum investment is ₹5,000. The NFO closes on 2020, 22 January. FOR MOR…

Edelweiss Tokio Life Insurance Wealth Secure+

Edelweiss Tokio Life Insurance Wealth Secure+ Edelweiss Tokio Life Insurance has launched a Ulip plan with greater

flexibility and no premium allocation charges. Wealth Secure+ can be used to meet both short-term, and longterm financial

goals.

Investment Returns: Share Market Vs Gold Vs Liquid Funds

Investment GuruWednesday, January 15, 2020GOLD - Bonds, GOLD - ETFs, Gold Investment, Investment - Alerts, MF - Debt Funds, Share Market - Alerts

No comments

Investment Returns: Share Market Vs Gold Vs Liquid Fund Over 1 Year, 3 Years, 5 Years and 10 Years As on Jan 13 2020 Thanks to ET

Indian Myeloma Congress 2020 organised by NIMS

Indian Myeloma Congress 2020 organised by NIMS · Mobile app launched

for Myeloma patients and doctors · An awareness walk was

held at NIMS Hospital campus Third Indian Myeloma Congress

2020 has been held at Nizam’s Institute of Medical Sciences, from 10-12 of

January 2020. …