CPSE ETF to Get

ELSS Income Tax Benefits - Budget 2019-20 For boost retail investments, the central government

wants to bring CPSE ETFs under the ambit of tax saving fund - equity linked saving schemes

(ELSS). This will make investments in CPSE ETFs eligible for income tax d…

Budget 2019-20- Compulsory INCOME Tax Filing Reintroduced

Budget 2019-20- Compulsory INCOME

Tax Filing Reintroduced Provision for

compulsory filing of returns introduced again. 1. You have to do

it if you have deposited Rs.1 one crore or more in bank accounts. 2. Have

electricity bills above Rs. 1 lakh. 3. Incurred

expenditure of mor…

PROPERTY TDS: Other fees also calculating - Budget 2019-20

Budget 2019-20 PROPERTY TDS: Other

fees also calculating In addition to

base price, other charges like club membership fee, car parking fee, etc will

also be considered while calculating TDS ,

Homebuyers avail additional Rs. 1.5 lakh deduction on home loan interest for properties worth up to Rs. 45 lakh :

Investment GuruSaturday, July 06, 2019Home Loan, Income Tax - Home Loan, JULY 2019, JUNE 2019

No comments

Housebuyers will

be able to avail an additional Rs. 1.5 lakh deduction on home loan interest for

properties worth up to Rs. 45 lakh. This is over

and above the existing deduction of up to Rs. 2 lakh. Effectively, home

buyers of affordable housing can claim deduction of up t…

Budget 2019-20 ; Option Buyers Get STT Relief

Option Buyers Get STT Relief, Trading a Lift In a major relief to options buyers, the union budget 2019-20 has proposed that securities transaction tax (STT) be calculated on the difference between the strike price & settlement price instead of the value of a contract. Sh…

20% tax on buybacks by listed companies - Budget 2019-20

The union government has proposed to introduce 20% tax on

buybacks by listed companies. Until now, such provisions were applicable

only to unlisted companies. The measure has been introduced by the

government to curb the misuse of the buyback route by listed entities to

…

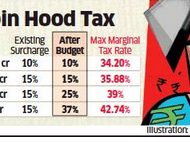

Budget 2019-20 ; Super Rich will have to pay up to 42.7% tax; Rs. 2-5 cr, Rs.5 cr+ brackets affected..!

Budget

2019-20 : Super Rich will have to pay up to 42.7% tax; Rs. 2-5 cr, Rs. 5 cr+ brackets affecte d Team ET Finance Minister Ms. Nirmala Sitharaman increased the 15% personal tax surcharge

on top-end income brackets for incomes between Rs . 2 crore and Rs. 5

crore, the new sur…

Full Budget 2019-20: 7 Share Market Reforms..!

Full

Budget 2019-20: 7 Share Market Reforms..! To allow FPIs and NRIs to subscribe

to listed debt papers of REITs and InvITs 2. 2. Asks SEBI to evaluate hiking minimum public shareholding to

25% from 35% Proposes rationalising and

streamlining of KYC norms for Foreign…

State Bank of India Releases Names Of 10 Big Wilful Defaulters

State Bank of India (SBI) revealed

names of ten new big ticket firms and their officials and declared them as

'wilful defaulters.' According to the public notice

issued by the Stressed Assets Management Branch 1 (SAM-1), Cuffe Parade, the

biggest defaulter on the lis…