Multi Cap Mutual Fund Minimum investment in equity & equity related instruments- 65% of

total assets. Multi Cap Fund- An open ended equity scheme investing across large cap,

mid cap, small cap stocks

SEBI Definition: Large Cap, Mid Cap and Small Caps..!

SEBI Definition: Large Cap, Mid Cap and Small Caps..! In order to ensure uniformity in respect of the investment universe for equity schemes, it has been decided to define large cap, mid cap and small cap as follows: Large Cap : 1st -100th company in terms of full market capit…

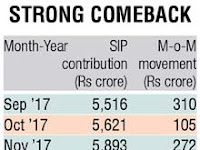

Indian Mutual funds garner Rs. 7,000 crore via SIPs in April 2018

Indian Mutual

funds garner Rs. 7,000 crore via SIPs in April 2018 Retail investors are

increasingly opting for systematic investment plans (SIPs) in mutual funds as

the industry has garnered close to Rs. 7,000 crore through this route in April,

2108 a surge of 57% from the …

Best IAS Websites for UPSC Civil Services Exam Online Preparation

Best IAS Websites for UPSC Civil

Services Exam Online Preparation insightsonindia.com clearias.com gktoday.in currentaffairsonly.com cleariasexam.com visionias.wordpress.com swapsushias.blogspot.in iaspassion.com iasscore.in iaskracker.com jagranjosh.com ias100.in jeywin.com civilsdaily.…

It had to happen! - on RBI Policy by Mahindra Group CFO Mr. V S Parthasarathy

on RBI Policy by Mahindra Group CFO Mr. V S Parthasarathy- It had to happen! As they say “It is either Day One or One Day – the choice is yours”! The RBI was in a Catch-22 situation in terms of managing a fine balance between emerging inflationary pressures and a nascent eco…

RBI’s Decision To Hike Rates May Not Have Significant On Ground Impact On Home Sales..!

RBI’s Decision To Hike Rates May Not Have Significant On Ground Impact On Housing Sales by Mr. Ramesh Nair, CEO & Country Head, JLL India The RBI’s decision to increase repo rates by 25 bps to 6.25% after 4 years of keeping them stable speaks of a carefully deliberated de…

RBI’s increasing repo rate by 0.25% is dampening the homebuyer..!

RBI’s decision of increasing the repo rate by 25 bps to 6.25% is dampening the homebuyer and developer sentiments.

Quote by Mr. Amit Ruparel - MD Ruparel Realty on RBI Monetary Policy “RBI’s

decision of increasing the repo rate by 25 bps to 6.25% is dampening

the homebuyer…

Here is one simple and best way to plan your expenses - Mr. Jagadeesh, kaaviyahomes.com

Here is one simple and best way to plan your expenses! 1. Financial freedom jar - 10% (never touch this, just keep investing) 2. Necessity jar - 55% (use it for regular needs) 3. LTSS - long term spending saving - 10% (for car, home, big tour- you can have separate jars for…

RBI Policy with neutral stance - R. Subramaniakumar, MD & CEO, Indian Overseas Bank

Views of Mr. R. Subramaniakumar, MD & CEO, Indian Overseas Bank On the Second Bi-monthly Monetary Policy The

Policy with neutral stance and the narratives are towards strengthening

the fundamentals, especially the inflation. Economic revival on a

sound footing and in…

The RBI decision to raise repo rate by 0.25% is a preemptive - SBI Chairman Mr. Rajnish Kumar

Quote of SBI Chairman Mr. Rajnish Kumar on RBI monetary policy The

RBI decision to raise repo rate by 0.25% (25 bps) is a preemptive and welcome

move. Simultaneously, the decision to keep the stance in neutral mode

indicates RBI willingness to be flexible and accommodati…