As per studies by PersonalFN Research team , As high as 32% of the mutual funds are WORTHLESS investments. PersonalFN Research team have been studying mutual funds for over 15 years now and this has turned into our profession from our passion over time... That means over one …

Mutual fund: 60% of investors use SIPs to invest: SEBI Survey Result

Mutual fund: 60% of investors use SIPs to invest: SEBI Survey Result About 60% of regular mutual fund investors use Systematic Investment Plans (SIPs) to invest in mutual funds, market regulator SEBU Survey revealed. The survey, called SEBI Investors Survey (SIS), 2015, hi…

Investing Mantra's - Stock - Our favorite holding period is forever - Mr. Warren Buffett

Investment GuruSaturday, April 08, 2017Investing Mantra's, Investing Mantra's - Investment, Investing Mantra's - Stock, Investing Mantra's - Warren Buffett

No comments

Investing Mantra's Investing Mantra's - Investment Investing Mantra's - Stock Investing Mantra's - Warren Buffett Our favorite holding period is forever." - Mr. Warren Buffett "When we own portions of outstanding businesses with outstanding managements…

BSE Sensex Journey From 23000 to 30000 APRIL 2017

BSE Sensex Journey From 23000 to 30000 Sensex

1000 Points

Journey Trading

Days 23000

to 24000 13 24000

to 25000 17 25000

to 26000 16 26000

to 27000 30 27000

to 28000 33 28000

to 29000 31 29000

to 30000

Reliance Mutual Fund, The Tamil Hindu - Investor Awareness, Meeting at Chennai On April 9, 2017

Reliance Mutual Fund, The Tamil Hindu - Investor Awareness Meeting Chennai On April 9, 2017 Time 10 am to 1 pm Entry free

Why do Indian Households Invest?

Why do Indian Households Invest? Capital gains, which are “… an increase in the value of a capital

asset (investment or real estate) that gives it a higher worth than the

purchase price”, is the primary purpose for household investing. Thus, capital gains closely followed by…

Household Awareness of Investment Instruments in India

Household Awareness of Investment

Instruments in India From SEBI INVESTOR SURVEY

2015 According to the SIS 2015 ( SEBI INVESTOR SURVEY 2015 ) data, the awareness

level forsavings instruments are almost identical amongst investors and

non-investors, whereas a familiarity with i…

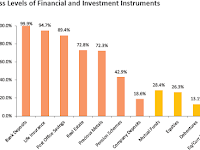

Awareness Levels of Financial & Investment Instruments Mutual Funds and Equities is just 28.4% and 26.3%, respectively

Awareness Levels of Financial and Investment

Instruments From

SEBI INVESTOR SURVEY 2015 Nearly all the survey participants are

staggeringly aware of Bank Deposits (99.9%), Life Insurance (94.7%) and Post

Office Savings (89.4%), familiarity with Mutual Funds and Equities is j…

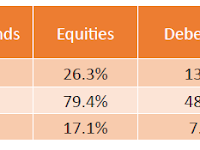

Indian’s Investments & Savings: Awareness & Preferences..!

Indian’s Investments & Savings:

Awareness & Preferences..! From SEBI INVESTOR SURVEY 2015 T he All India Debt and Investment Survey (AIDIS); the key

findings from the latest (70th) round was published in December 2014 28 . Nevertheless, the NSSO survey’s coverage, while

…