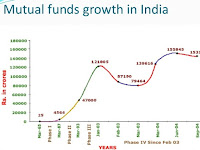

Mutual Fund Asset Monitor - December 2015 Assets under management (Rs.Crore) Mutual Fund Company September 2015 December 2015 Change (Rs.Cr) Change ( %) HDFC

Mutual Fund 170,838 178,373 7,535 4.41 ICICI

Prudential Mutual Fund 164,629 172,154

Amazon.in Announces the ‘Great Indian Sale’

Amazon.in Announces the ‘Great Indian Sale’ Enjoy Amazon.in’s amazing 72 hour deal

marathon between January 21 st – 23 rd , 2015 There couldn’t have been a better start to the year! Get

ready to shop more and save big in the new year with the ‘Great

Indian Sale’ on Amazon.in. Sta…

Why Builders Launch Projects Even In Slow Market Conditions

Why Developers Launch Projects Even In Slow Market

Conditions by Mr. Kishor Pate, CMD – Amit Enterprises Housing

Ltd. Top developers / promoters / builders have a strategy of

launching new projects even in a slow market, and there is sound

logic behind this. There is always…

Invest in Gold : Sovereign Gold Bonds at 2.75% interest per annum

Invest in Gold in Demat / Paper form through Sovereign Gold Bonds at

2.75% interest p.a. To apply visit your branch / log on to FedNet- Federal Bank

Investment in Debt Mutual Fund, Gold, Real Estate: How indexation works..?

Investment GuruMonday, January 18, 2016Alerts - Income Tax, Income Tax, Income Tax - Investments, News - January 2016

No comments

Investment in Debt Mutual Fund, Gold, Real Estate: How indexation

works..? Indexation is a process by which

the government compensates investors in debt, gold, real

estate etc so that the investor does not have to incur any loss in real terms. Due to inflation, the market

pri…

ELSS Verses OTHER TAX SAVINGS Plans

Investment GuruFriday, January 15, 2016Alerts - Income Tax, News - January 2016, Tax Saving Investment - MF

No comments

ELSS Mutual Fund Verses OTHER TAX SAVINGS Plans Particulars PPF NSC ELSS Bank Fixed Deposits ULIPs Tenure years 15 years 5 and 10 years 3 years 5 years 5 years Minimum Investment Rs. 500 100 500 1,000

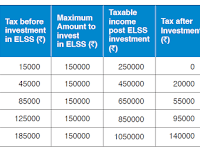

Tax Saving through ELSS Mutual Fund

Investment GuruFriday, January 15, 2016Income Tax, News - January 2016, Tax Saving Investment - MF

No comments

Tax Saving through ELSS Mutual Fund 1. EL SS (Equity Linked

Savings Scheme) are diversified equity funds with a lock-in period of three (3)

years. 2. Income Ta x benefits under

Section 80C of the Income Tax Act, 1961 according to which investment upto Rs.

1.5 lakhs (FY 2015-1…

Triple Benefits of investing in ELSS Mutual Fund

Investment GuruFriday, January 15, 2016Alerts - Income Tax, Income Tax, Income Tax - Investments, News - January 2016, Tax Saving Investment - MF

No comments

The 3 Benefits of investing in ELSS ( Equity

Linked Savings Scheme) Mutual Fund 1. Income Tax Savings 2. Potential Capital Appreciation 3. Tax Free Returns.(Dividends and Growth) Mutual Fund investments are subject to market risks, read all scheme related documents carefully. …