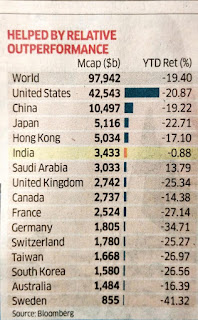

Indian stock market faired well comparing other countries. Saudi Arabia is the only positive market YTD period. (Year to Date).

*How does India fair well in crisis?*

The war impacted the world economy on the Oil front. Major countries suffered losses in their books to pay higher oil prices. And that increased the cost inflation of domestic products.

Saudi, being an oil export country escaped the crisis factored by Oil.

India managed to buy Oil from Russia which attracted FIIs to India and managed the Dollar outflow from FII inflows.

*What is the opportunity it has now?*

MSCI India Index outperformed the MSCI Emerging Market Index - That means, the FII invested in India benefitted from India's move comparing other investments in emerging markets like India.

India's weightage in MSCI is almost 14%, the second largest allocation next to China.

We have a very good opportunity that MSCI can increase the allocations further. And that may be the reason FII's continuously buying in India.

*What is the risk it has now?*

The Indian market is more at risk comparing other countries due to its high valuation. Any adverse event can trigger a downtrend.

US interest rate hike will impact the rupee valuation and can trigger more outflows of dollars from the reserve. Interest rate hikes in India will impact growth and bring in a slowdown.