Indian Financial Markets: Primary Drivers - Urbanization

and socio economic growth

Form

SEBI Investor Survey 2015

Urbanization and socio economic growth are two

interconnected significant drivers, which are expected to drive investment

growth and an increased penetration in securities markets.

According to the SEBI Investor Survey 2015 (SIS 2015)

data households with similar education and income (the two primary drivers of

socioeconomic growth) in urban areas tend to invest significantly more in the

markets than those in rural areas. 7.1 crore people were added to India’s

cities between 2001 and 2011 and the urban population rose from 27.8% to 30% of

the total population.

By 2026, the urban population is expected to increase to

over 50 crore people, which will constitute 38% of the total Indian population.

In conjunction with this rapid urbanization, the GDP growth rate in India has

strong sectoral differences, some of which may support the development and

growth of stock markets.

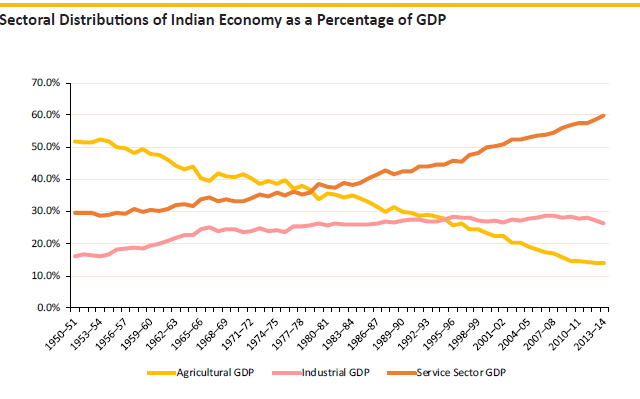

Figure 2.3 corroborates the sectoral evolution in the

economy since Independence. The service sector has doubled (as a percentage of

GDP) from less than 30% of GDP (constant prices) in 1950-51 to nearly 60% in

2013-14.

The related concepts of urbanization and service sector

growth in the economy bode well for broader participation in the securities

markets. This, in turn, is an essential component for financial stability and

economic growth in emerging markets.

According to the IMF’s analysis regarding emerging

markets, “Financial development increases a country’s resilience and boosts

economic growth. It mobilizes savings, promotes information sharing, improves

resource allocation, and facilitates diversification and management of risk. It

also promotes financial stability to the extent that deep and liquid financial

systems with diverse instruments help dampen the impact of shocks.”

Policy makers and governments need to be cognizant of

this essential facet in a country’s development paradigm as they create their

road maps for economic growth.